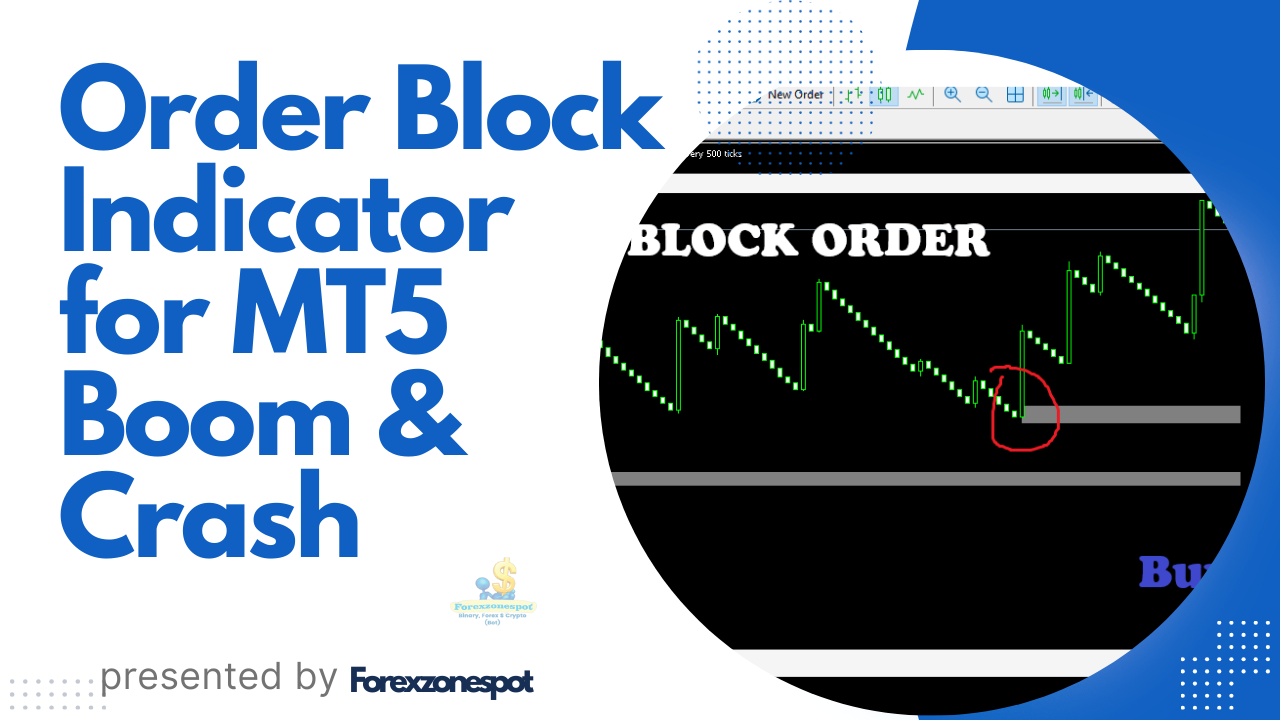

Introduction: Order Blocks For MT5

The indicator designated as the Order Blocks for MT5 gives important data about the market structure. The indicator highlights primary transition and depletion angles of momentum. As a result, BUY and SELL conditions are identifiable by forex traders within the Bullish and Bearish price reversal areas. Also, the indicator alerts users when a trading signal is ready.

A market structure identified as the last Bearish candle before a Bullish price move and reversely for a reversed situation. orders blocks offer a framework where traders expect the price to change direction. The indicator is appropriate for seasoned traders. Yet, new traders can develop knowledge with the right amount of practice. This indicator is effective for all intraday periods as well as on the daily, weekly, and monthly price charts.

Subscribe here on my YouTube Channel

The presented Boom&Crash M1 shows the Order Blocks for MT5 usage. The indicator illustrates the WHITE Bullish order blocks along with the GREY Bearish order blocks. Moreover, the indicator warnings happen via message, sound, and push notifications. The user requirements allow for their feedback in the indicator settings.

Download the RANGO LAST DIGIT V4.0

Reaching the Bullish order block price shows the likely reversal of the price. Thus, technical traders need to find a BUY entry point. It should be reliant on the price action occurring within the Bullish order block. The Bullish order block is an indicator of solid support. All technical indicators apply to confirming support. Technical trading approaches also apply to buying within the Bullish order block. Being below the order block or the former swing low shows the best place for a stop loss. Still, positions for take profit are a matter of the risk-reward scenario or the next available resistance.

Should the price fall into a Bearish order block, Forex traders should set up a SELL position. They should expect a market reversal. The leading entry within the Bearish zone is driven by price action. Results are ideal when a stop-loss is placed just above the order block or last swing high. Still, traders ought to try to realize profits with an attractive risk-reward ratio.

The block zone is not just one line or point. Forex traders ought to review the order block and respond appropriately inside the zone. The separation of the order block signals a prospective shift point for the trend towards the counter-trend. The order blocks that carry on with the prevailing trend often deliver better returns. They have a decent risk versus reward ratio.

Discover more from Forexzonespot

Subscribe to get the latest posts sent to your email.