Scalping Trading Forex: First of all,

In the forex market, scalping is a well-liked trading technique that enables traders to profit on brief price swings. By making use of the robust MT5 platform, traders may improve the efficacy of their trades and their scalping method. We will examine the Scalping Trading Forex MT5 moving in this article, with particular attention to trend analysis with Moving Averages, choosing good currency pairs, establishing proper TP and SL ratios, identifying ideal time frames, and making use of the MT5 platform. The significance of minimizing risk by avoiding trading in response to news releases will also be covered.

Scalping Trading Forex: Pairs of currencies:

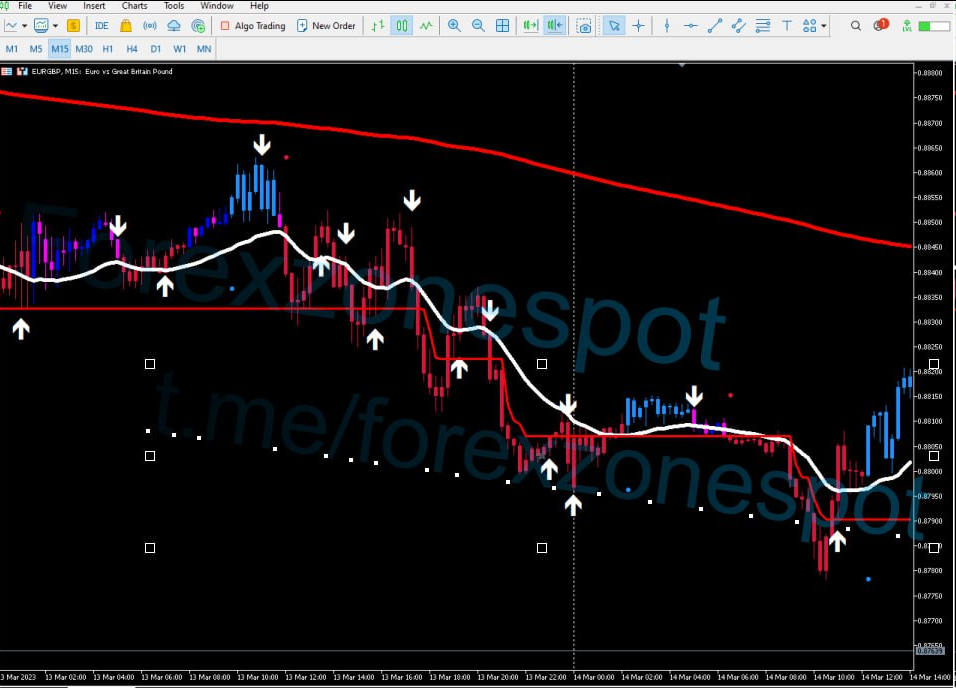

The Scalping Trading Forex MT5 Strategy relies heavily on selecting the appropriate currency pairs. It is advised to concentrate on currency pairs with positive price moves and adequate volatility. For this approach, EUR/USD, AUDNZD, EURGBPP, and USDJPY are the ideal pairs. These pairs are renowned for their adaptability to changing market conditions and liquidity.

Comprehending the Approach

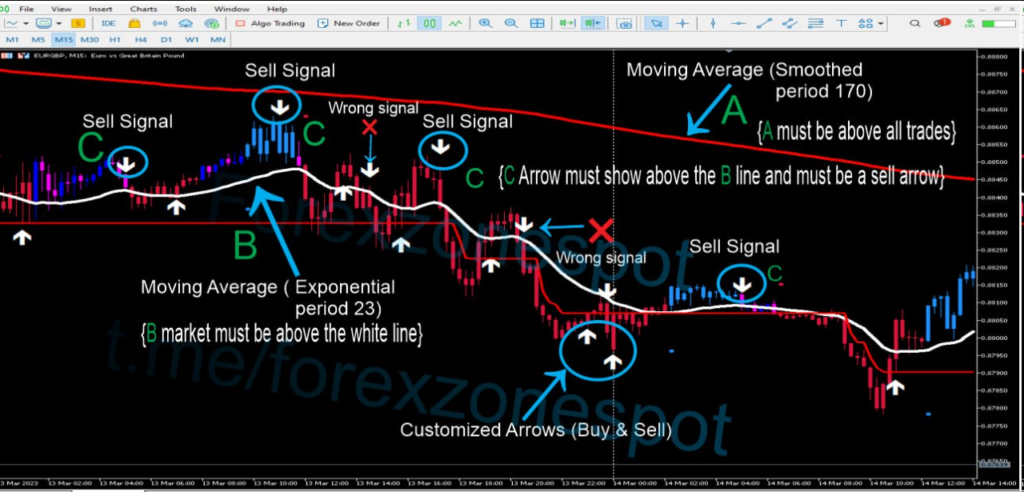

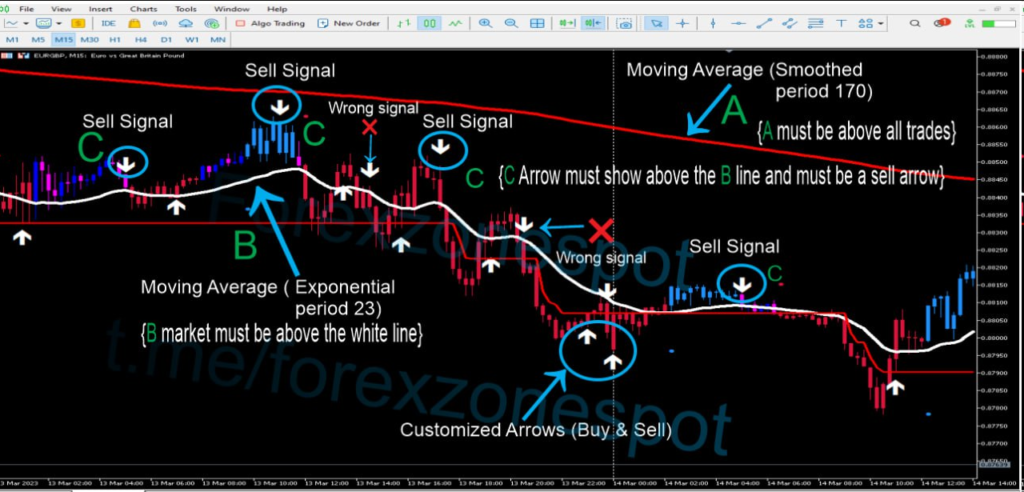

Let’s review the main elements of the plan before getting into the specifics. Three key components comprise the strategy: custom arrows (C), moving averages (A and B), and both.

Moving Average A: The long-term trend is shown by Moving Average A, which is represented by a red line. This line indicates a potential selling opportunity when it appears above all trades.

Moving Average B: A short-term trend is shown by Moving Average B, which is represented by a white line. You can get ready to make a sell transaction when the market moves over this line.

Custom Arrows (C): These arrows serve as signals for purchases and sales. They represent a legitimate indication to take into consideration for a sell transaction when they appear over the white line.

By ensuring that winning transactions exceed lost ones, this strategy lessens the impact of any losses.

After you’ve determined the market and timeline, move on to steps A, B, and C:

A: Examine the red line’s moving average analysis. Make sure it appears above all other deals, suggesting a time to sell.

B: See if the market rises over the short-term trend line, shown by the white line. That gets you ready for a sale when this requirement is satisfied.

C: Notice how personalized arrows start to show up above the white line. These arrows are legitimate signals for sales.

It is noteworthy that to identify possible purchasing opportunities, the opposite conditions (and vice versa) should be taken into account. The goal of the approach is to offer precise instructions for carrying out trades that have a high chance of success.

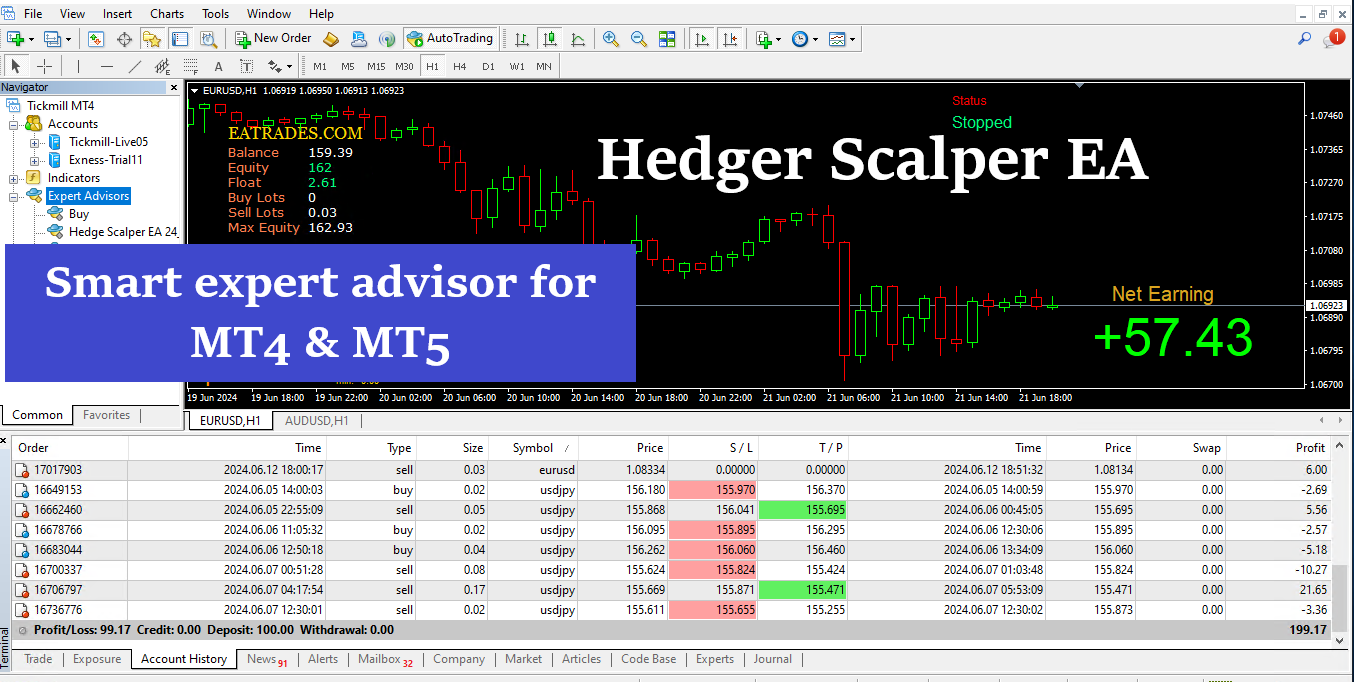

MT5 platform:

The most popular platform among forex traders globally is MT5. The platform’s sophisticated technical analysis tools and intuitive interface make it perfect for implementing the Forex MT5 Scalping Trading Strategy. With its wide selection of indicators, easily customizable charts, and rapid order execution, traders can quickly and profitably put their scalping approach into practice.

Please contact @forezonespot on Telegram for further details and an in-depth analysis of this tactic. Their team of professionals specializes in Forex Trading Scalping Strategies and can offer helpful advice to enable you to apply these cutting-edge methods with efficiency.

In summary:

One effective method for maximizing returns in trending markets is the Forex MT5 Scalping Trading Strategy. Traders can improve their scalping approach and raise the probability of profitable trades by combining Moving Average trend research, picking relevant currency pairs, putting in place optimal TP and SL ratios, using short time frames, and utilizing the MT5 platform. To reduce risk, it is crucial to be cautious and refrain from trading in response to news releases. In the ever-changing forex market, traders can fully realize the potential of scalping trading by exercising discipline, practice, and appropriate risk management strategies.

Discover more from Forexzonespot

Subscribe to get the latest posts sent to your email.